Real estate is the largest asset class in the world. In fact, global real estate is a more valuable asset class than all stocks and bonds combined. Although it used to be dominated by large, sophisticated investors, online rental platforms like Airbnb and VRBO now make real estate investing accessible for small investors. Are you interested in investing in real estate but are unsure where to begin? This guide highlights what you should focus on and shares the European city with the highest rental yield.

The case for investing in European property

There are many reasons to invest in European property. Some are personal, some are practical and some are purely financial related.

Diversification

The key to smart investing is to diversify your investments across asset classes and geographies. If you are American, your biggest investment is probably your home. If you have an equity/bond portfolio, its holdings are most likely concentrated in US assets. Investing in European real estate will allow you to diversify your investments across both asset classes, and geographies, with a single purchase.

Return optimization

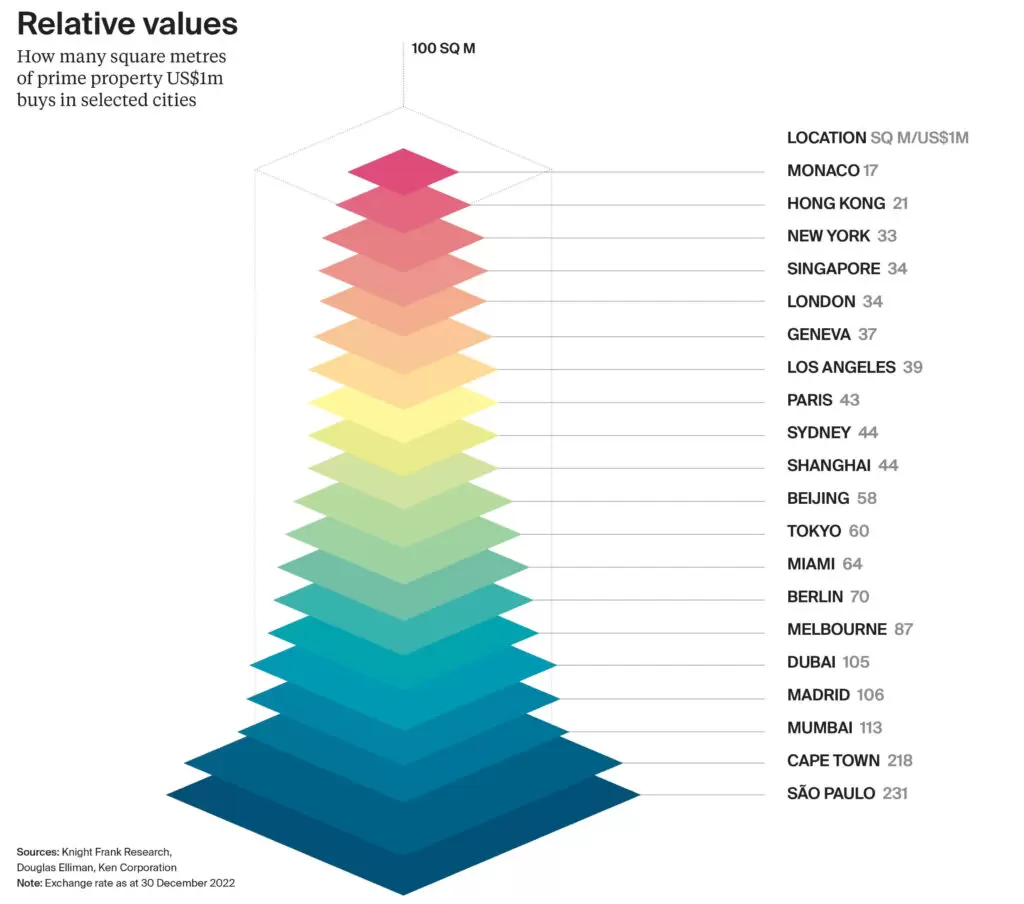

In short, more successful real estate investments generate steady returns (rent paid) for low initial investment thresholds. This is why, even though rents in New York City are the most expensive in the US, it isn’t the most profitable place for real estate investment because the initial investment required is so high.

European cities with less expensive real estate, such as Madrid and Athens, typically generate higher returns that investing in real estate in expensive cities like New York, Paris or Los Angeles. Moreover, since Europe is the most visited continent in the world, there is high demand for European real estate not just from locals, but from international travelers. To illustrate: France is the most visited country in the world, with 117.1 million international tourists per year. The United States, which is much larger, only receives 45 million. Spain also receives a high number of international tourists, with 36.4 million per year.

Vacation home

If you like to travel, you can rent your European investment property short or medium term, using it as a vacation home when it is vacant. If you have the luxury to take longer vacations, you can use it as a base for visiting various locations in Europe, North Africa and the Middle East. Budget airlines have caused European airfare to drop significantly. One can fly from Madrid to most European cities for easily under 100€ and flight times are generally only a couple hours.

European residency

Some countries offer European residency for real estate investments over a certain threshold. However, many of these programs have been abolished. Both Spain and Portugal have ceased granting golden visas.

Key factors to take into consideration

Aside from personal preference, there are important financial factors to take into consideration for a successful real estate investment.

Rental yields

Rental yields are how investors quantify the performance of real estate investments. The higher the rental yield, the better.

Gross vs. Net rental yields

A gross rental yield is the annual return on your real estate investment, divided by the initial cost of the investment. The goal is purchase a relatively cheap property that you can rent for a relatively high rate.

Net rental yields take into account not just the purchase price of your real estate investment, but also the costs associated with maintaining the investment. Costs include taxes, home insurance and line items like utilities and property management fees if you rent your property short or medium term. Rental returns are inversely correlated with the term of property rentals. Short term rentals, using platforms such as Airbnb and VRBO, have higher returns than apartments that are rented long term (for a year or more). The returns on medium term rentals fall somewhere in between. To learn more, we suggest you read this article: How to maximize your rental property yield

The European city with the highest rental yield

Using data from Deloitte’s 2023 European Property Index, we calculated gross rental yields across all major European cities. The clear winner is Madrid. It has relatively low residential real estate prices (21.5€ per square meter, vs. 28.5 in Paris and 26.8€ in London). Moreover, monthly rents in Madrid are quite high: the average monthly rent for a 100 square meter property is 2,150€. Thus its gross rental yield is 5.1%:

Madrid also has a relatively low cost of living, which also means we can easily infer that it also has the highest average net rental yield of any major European city.

Occupancy rates

The occupancy rate is the percentage of days, per year, your property is rented. Long term rentals typically have high occupancy rates. If rented year after year to the same tenant, they can consistently be 100%. Short term rentals typically have lower occupancy rates, which are based on a variety of factors. The biggest factor for vacation rentals tends to be seasonality. Many people, due to school and work schedules, take their big vacations in the summer. This, combined with the fact that weather in the northern hemisphere tends to be more pleasant in the summer, means that occupancy rates are typically higher in the summer than the winter.

Housing supply and demand also affects occupancy rates. Amsterdam, for example, has a very high median occupancy rate (90%) because there is a severe lack of housing in The Netherlands. Paris also has a very high median occupancy rate (89%) because it is the most visited city in the world and also has a limited housing stock. In general, Europe has the highest occupancy rates in the world.

Average revenue

Average revenue is driven by rental yields and occupancy rates. The ideal situation is to have a very high rental yield AND a very high occupancy rate, resulting in high average revenue. However, there is often a trade off between the two. Ultra luxury properties that are able earn very high rental yields often have lower occupancy rates because the amount of people that can afford them is limited. This is why it is so important to work with a professional property manager with experience in your market. They can help you maximize your average revenue by choosing the optimal pricing for your investment property, taking into consideration factors such as seasonality and other properties in your market.

Madrid Estate offers a complete array of real estate services, including property management. We invite you to arrange a FREE CONSULTATION TODAY to learn how we can help you manage your Madrid real estate investment to maximize your property’s annual revenue.

Regulations

Aside from the financial aspects of a real estate investment, you should also take into consideration any regulatory aspects involved. If you are planning on renting your property short term to maximize your rental yield, it’s important to realize that many cities have imposed regulations on short term rentals. To learn more about this, we invite you to read our report on New European Airbnb regulations

The City of Barcelona, for example, has banned short term room rentals. One can still rent their entire apartment short term, but must have the proper license. However, the Catalan authorities are no longer issuing tourist licenses, so if you want to rent your property short term you must purchase a property that already has a license; these are priced at a high premium to properties that don’t have licenses. There is no room for skirting these regulations- the authorities have an entire team dedicated to scouring Airbnb listings, removing any that do not comply with regulations and issuing fines for violating the regulations.

Paris is another city that has cracked down on short term property rentals. The biggest restriction is that you can only rent your primary residence short term, and you can only do it for four months out of the year. If you want to buy a dedicated investment property, you have to apply to convert the residential property into furnished tourist accommodation. This is not an easy process. Most restrictively, you must prove that you have tripled that amount of residential space elsewhere in the neighborhood. As in Barcelona, these regulations are strictly enforced. Aside from Airbnb being fined, individual landlords face fines of up to 50k€ for illegally renting properties.

Tourist licenses are required to operate Airbnbs in Spain; the City of Barcelona no longer issues tourist licenses. The City of Madrid issues tourist licenses, but the property must be a ground or first floor property with no neighbors underneath. Furthermore, there are additional requirements, stipulated by the city, that you must meet. Finally, the property must be certified by an architect. To obtain one, property owners must obtain a certificate from an architect stating that all the city’s requirements are met. These are basic amenities and safety measures; the property must have hot and cold water, heating, direct ventilation to the outside, a fire extinguisher, emergency signs and an evacuation plan. If your neighbors report that your property doesn’t meet the regulations, and you are found guilty, the city is issuing fines of 15k€ to Airbnb owners.

Conclusion

Recently released data from Deloitte demonstrates that the European city with the second highest rental yield is Madrid; only Dublin is higher. Thus from a financial perspective, it is the best major European city for real estate investment. It’s even more desirable because the regulation for medium and long term property rental is relatively lenient.

Do you want to get started finding your ideal Madrid investment property? If so, arrange a FREE CONSULTATION TODAY to get the process started.