Now that central banks are finally starting to lower interest rates, here is everything you need to know about Spanish mortgages for investors. We also discuss the viability of getting a Spanish mortgage if you are looking to purchase property in Spain.

Current interest rate environment

After years of steady increases, interest rates are either poised to decrease, or have already done so. In June 2024, the ECB decided to lower the three key ECB interest rates by 25 basis points. Less than two months later, the Bank of England’s Monetary Policy Committee (MPC) announced it had cut interest rates from 5.25% to 5.0%.

Although the US Federal Reserve has yet to cut interest rates, investor consensus is that, for the first time in over four years, it will begin cutting interest rates in September.

The primary reason central banks began raising interest rates was to curb inflation and keep economies from over heating. In July, 2024 the US Consumer Price Index (CPI) revealed that the inflation rate was at 2.89%, compared to 2.97% in June and 3.18% in July, 2023. This 2.89% inflation rate is lower than the long term average of 3.28%. Almost all metrics demonstrate that Jerome Powell (the Chair of the US Federal Reserve), has successfully engineered a soft landing for the US economy and it’s now time for interest rates to decrease. His remarks on August 23, 2024 signaled that the Federal Reserve will begin cutting rates in September.

The link between interest rates and mortgage rates

Central banks have a number of monetary tools available to begin bringing interest rates down. In simple terms, they involve setting the interest rate(s) that banks can borrow and lend to each other. Changing these allows central banks to either inject liquidity into the banking system, or remove liquidity from the system. After that, it is simple supply and demand at work. Injecting liquidity means there is more money available, so overall interest rates decrease. Interest rates are just the price of borrowing money; if the money supply increases, the price of borrowing money goes down. If the money supply decreases, the price of borrowing money increases.

Mortgage rates and official interest rates (eg: the federal funds rate) usually move in the same direction, but the correlation isn’t direct. It can be difficult to determine whether mortgage rates follow the Fed’s actions or the other way around. This is because of the role that expectations play in the financial markets. Investors form expectations around key events (central bank actions, company earnings, world events, etc.) and then try and take actions before these events occur to make money. Thus if there is a consensus among investors that central banks will lower inter bank lending rates (ie: lower “the interest rate”), mortgage rates usually drift in the direction that the central bank is expected to move. Often, by the time of the central bank meeting, mortgage rates already reflect the expected rate change.

For example, US mortgage rates resumed their downward path in August, dropping to a new low for the year. This occurred even though the Federal Reserve has yet to lower the federal funds rate.

European mortgage rates also dropped ahead of the ECB lowering their three key interest rates in June 2024.

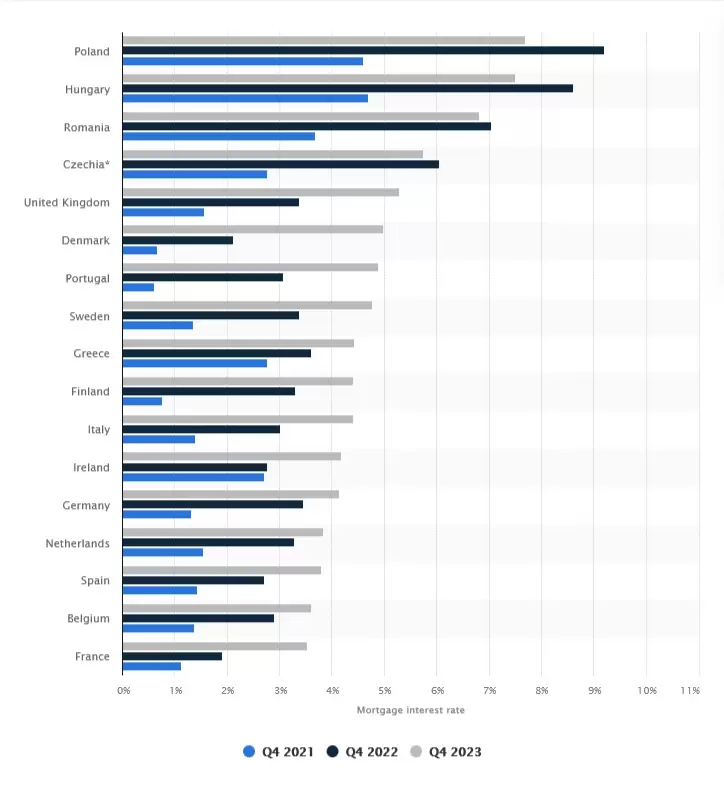

Are mortgage rates the same across the euro zone?

In short, the answer to this is no. There is often a great variation between mortgage rates in different European countries. This is because of the indirect correlation between inter bank lending rates and mortgage rates.

Interest rates in Spain are often among the lowest in Europe and are expected to drop further. As Idealista wrote in April, 2024,

“Many banks started to lower their mortgage offering in the first weeks of the year [2024], anticipating the future interest rate cuts that the European Central Bank (ECB) will undertake in the coming months. And this twist in the mortgage war seems to have only just begun.

According to Juan-Galo Macià, president of Engel & Völkers for Spain, Portugal and Andorra, during the presentation of a report on the real estate market, ‘a spectacular mortgage war is breaking out that will no doubt speed up the market’.”

How do Spanish mortgage rates compare to US interest rates?

Due to big differences in the US, Euro zone and Spanish financial systems, Spanish mortgage rates are much lower than US interest rates.

Since Spanish interest rates are so relatively low, and expected to go lower, we recommend that our clients explore Spanish mortgages for investors.

Not a client of Madrid Estate? We would love to help you find and purchase your investment property in Madrid. CLICK HERE to obtain a FREE CONSULTATION to learn how we can work together.

Can a person that isn’t a resident of Spain obtain a Spanish mortgage?

Yes, a person that is not a Spanish resident can obtain a Spanish mortgage. However, banks view lending to non-residents as riskier than lending to residents, so:

- You will have to pay a larger down payment than a resident.

- Your mortgage rate will be higher than those published for residents.

- The criteria for non-EU citizens may be different compared to those who reside in the EU.

This said, it is almost always better to leverage an investment property purchase. That is because leverage can significantly expand the potential for returns.

Where to get started in obtaining a Spanish mortgage

We recommend that you work with a mortgage broker. People often shy away from mortgage brokers because they don’t want to pay the broker fees. But it’s important to realize that brokers usually obtain favorable rates, which can offset their fees. Brokers have relationships with a multitude of Spanish lenders; they are often aware of opportunities that are not widely recognized. Moreover, many brokers specialize in working with people from abroad. Thus they are often able to increase one’s chance of getting a Spanish mortgage.

Even if you work with a mortgage broker, you will eventually need to interact with Spanish banks. The Spanish banking system is adequately capitalized and well functioning. However, from a consumer standpoint, there are many quirks that make banking in Spain different than other countries. Before you step foot in a Spanish bank, we recommend you read: Spanish banking tips for expats.

What size of Spanish mortgage can an investor expect to receive?

While residents in Spain can get up to 80% financing when buying a primary residence, non-residents can expect the majority of Spanish lenders to only allow them to borrow 60% of the sale value of the property. In some special cases, this may rise to 70% but this is unlikely. This has increased in recent years (it used to be capped at 50% of the property price) as more foreigners purchase property in Spain and Spanish banks become more comfortable lending to them.

Are there additional fees associated with obtaining a Spanish mortgage?

Yes, there are three: arrangement fees, valuation fees and costs associated with obtaining additional insurance.

Arrangement fees

Arrangement fees, often called opening fees, are charged on every Spanish mortgage. They are not payable until the mortgage is granted and you use the funds. If you are granted a mortgage, but decide not to draw on the funds, you will not be charged this fee. Typically, arrangement fees are 1-2% of the gross loan amount.

Valuation fees

Before you are granted a Spanish mortgage, the property must be valued by a third party. Most banks offer very fair rates for this service, thus arranging your own valuation is typically not worth the effort. Valuation fees are usually around 0.1% of the value of the property.

Additional insurance costs

Most Spanish lenders require that you have both life insurance (in case you die this provides funds for the loan to be repaid) and property insurance. In the past, banks used this as an opportunity to cross sell their mortgage clients insurance products by raising their interest rate if they went with third party insurance. A revamp of Spanish mortgage laws now requires Spanish lenders to accept third party insurance; they can no longer threaten to raise the interest rate on a client’s mortgage offer if the client uses an external vendor. They can offer a lower mortgage rate if someone buys their insurance, but it must be in a separate offer that the potential client can use to compare different insurance products.

Madrid Estate has a great deal of experience working with Spanish mortgages for investors. We have connections with a number of mortgage brokers and can help guide you through the process of obtaining a Spanish mortgage. Arrange a FREE CONSULTATION TODAY to learn how we can work together to make a favorable investment in Madrid real estate.